Tech Approaches its 'Malaise Era'

Big Tech is a fluke of 2010s monetary policy, and it wont' survive for much longer.

In part 2 of this series I attempted to break down the economic challenges the Trump administration will face in its second term, regardless of what policies he tries to force through. We’re now one week into Trump II and I can confidently say, the situation is much worse than I thought, especially for the Tech Sector. I’ve long though that Tech is headed for its own version of the Malaise Era, an age of the Automobile Industry roughly lasting from the early 1970s to the mid 1980s where product quality, industry growth, and job satisfaction all declined. The golden age of internal combustion had come to an end. Today, Big Tech faces a similar fate.

How We Got Here

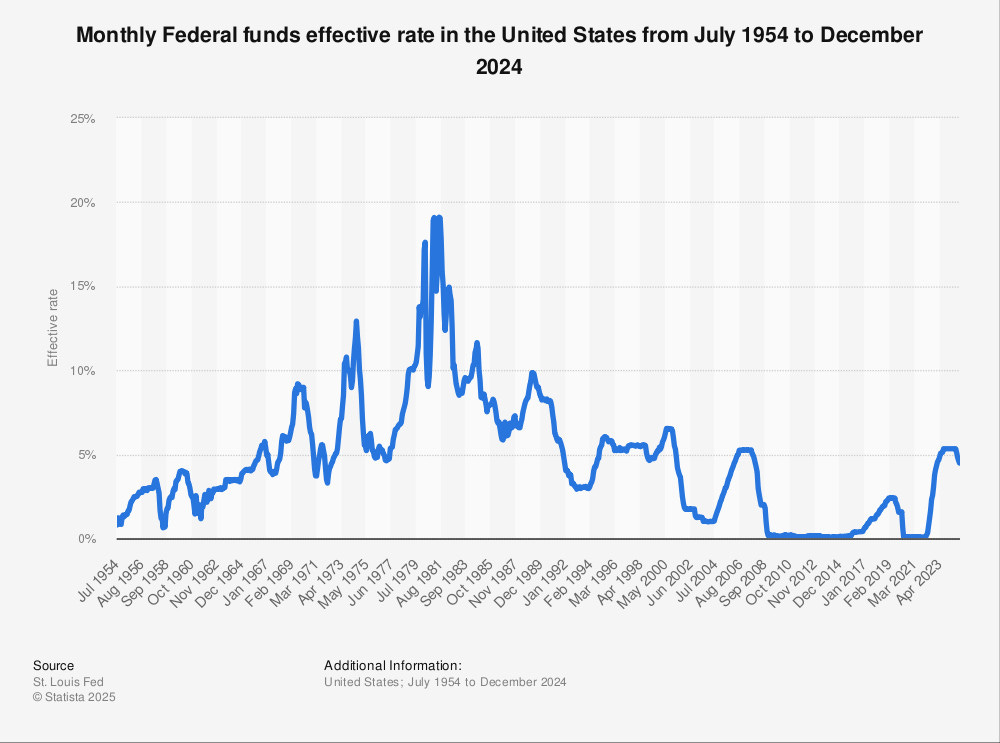

First, we need a little history lesson of how the tech sector, as we know, it came to be. Because of deregulatory policies initiated in the United States in the 1980s, Venture Capital investors (VCs) are able to borrow against stocks and tradable financial assets (securities). While the wealthy frequently do this to buy homes, cars, jets, etc. this is mainly used to invest in more companies, thereby growing the wealth of investors. After the Crash of 2008, most national banks lowered and held interest rates on government bonds close to zero, freeing up the money supply to avoid a deflationary spiral, but also making debt so cheap that VCs could invest in companies that consistently lost money with no real risk.

Big Tech had always placed a high premium on appearing valuable along with turning a profit, but this new age of cheap capital made it so the goal of tech startups was only to appear valuable. The easiest way to do increase company valuation was to increase how many people used a product. Userbase growth had been used as promise of profitability before, but now it was a grift purely to create the perception of value and attract more investors. Social media by its very nature was the biggest beneficiary of this model, as those companies could rapidly attract huge numbers of users. Twitter’s success was due in part to microblogging being the simplest possible service to launch: a bunch of public text message. This allowed it to grow at a breakneck pace, which allowed it to raise huge amounts of capital, which allowed it to then add features like image and video hosting to attract more users. “Growth at any cost ,” was the name of the game, and it didn’t take long for the grifters to grift the other grifters. VC money is now used to pay for bots to fake user growth, thereby attracting more VC money.

For 9 years debt remained cheap enough for social media to grow from a market of around $1.4 Billion in 2008 to over $251 Billion in 2024. But by 2017 the world economy had largely recovered from the Great Recession and was growing again. This made near-zero interest rates not only unnecessary, but dangerous as it now risked creating an inflationary spiral. So national banks began to raise interest rates, and thus reducing the money supply. But as we all know, inflation kept rising anyway. This is partly from the culture of overinvestment in those 9 years after the Crash of ‘08, but also from supply chain interruptions created by the labor shortage . Outside of a brief return to near-zero rates during the COVID-19 Pandemic, debt kept getting more expensive and investors could no longer pay back loans taken out against stock with ease. This has upended the logic Big Tech has operated on since 2008.

There's no way out for the Tech Sector. Anything social media does to try and turn a profit reduces users, because people only use social media because its free. If users bases decline too much, too fast, investors will dump their stock leaving the companies with no money. They need money to restructure their companies to turn a profit by charging for services or reducing costs by cutting features. But if they do that people leave and they lose investors. They're trapped, and its only a matter of time before there’s a Crash.

AI Bubble

To understand how Big Tech will fall apart, we have to look to the biggest money pit in modern economics: AI. At the end of 2024 most estimates suggested that AI projects had vacuumed up over $200 Billion in investor capital. On the second day of his second term, Donald Trump announced a joint venture to invest another $500 Billion in AI infrastructure over the next 5 years. Silicon Valley and market watchers hailed this as a huge injection of confidence in AI, which was facing growing skepticism at the end of last year. However, the situation is not as rosy as Silicon Valley wants to believe. Firstly, the $500 Billion joint venture is actually only a $100 Billion investment, with no requirements for follow on investment over the life of the program. That would buy AI maybe six months of life based on last year’s estimates. Secondly, those estimates turned out to be wrong.

AI doesn’t cost $200 Billion a year, it cost $600 Billion, meaning the Trump administration joint venture covers the cost of 2 months of operating AI projects. If Large Language Models (LLM) actually were the game changing technology Silicon Valley claims them to be, this wouldn’t be a problem because the companies would be making huge profits to justify the costs. However, that is not so. OpenAI, the makers of ChatGPT, reported only $3.4 Billion in revenue last year, and Sequoia Capital’s own fairly optimistic projections figure the entire industry is generating maybe $100 Billion in revenue. Given that the global art market only accounted for around $67.8 billion in 2022, that services like Alexa are mostly used to tell time and set reminders, and usage rates of AI tools per month is in the single digits, I think we can confidently say those revenue projections are soft.

An AI winter is coming, and it that should not be a surprise at this point. Even if all of these other problems weren’t true, the LLM technology has reached its limit, as there isn't enough data to make substantive improvements, and the content generated by LLMs is creating negative feedback loops. The AI Bubble is going to burst, soon, its just a question of what will kick off the panic in the market. What is a certainty, is that the panic will spread as investors try to recover losses from this $600 Billion white elephant. We’re already seeing the beginnings of this with X, as banks are now preparing to sell off Musk’s debt that he incurred when buying the social media company. While AI and X are the most obvious bad bets in the Tech Sector, the problem is systemic. Trump might be able to force the Fed to cut interest rates, but that is no longer a viable solution to the impending crisis.

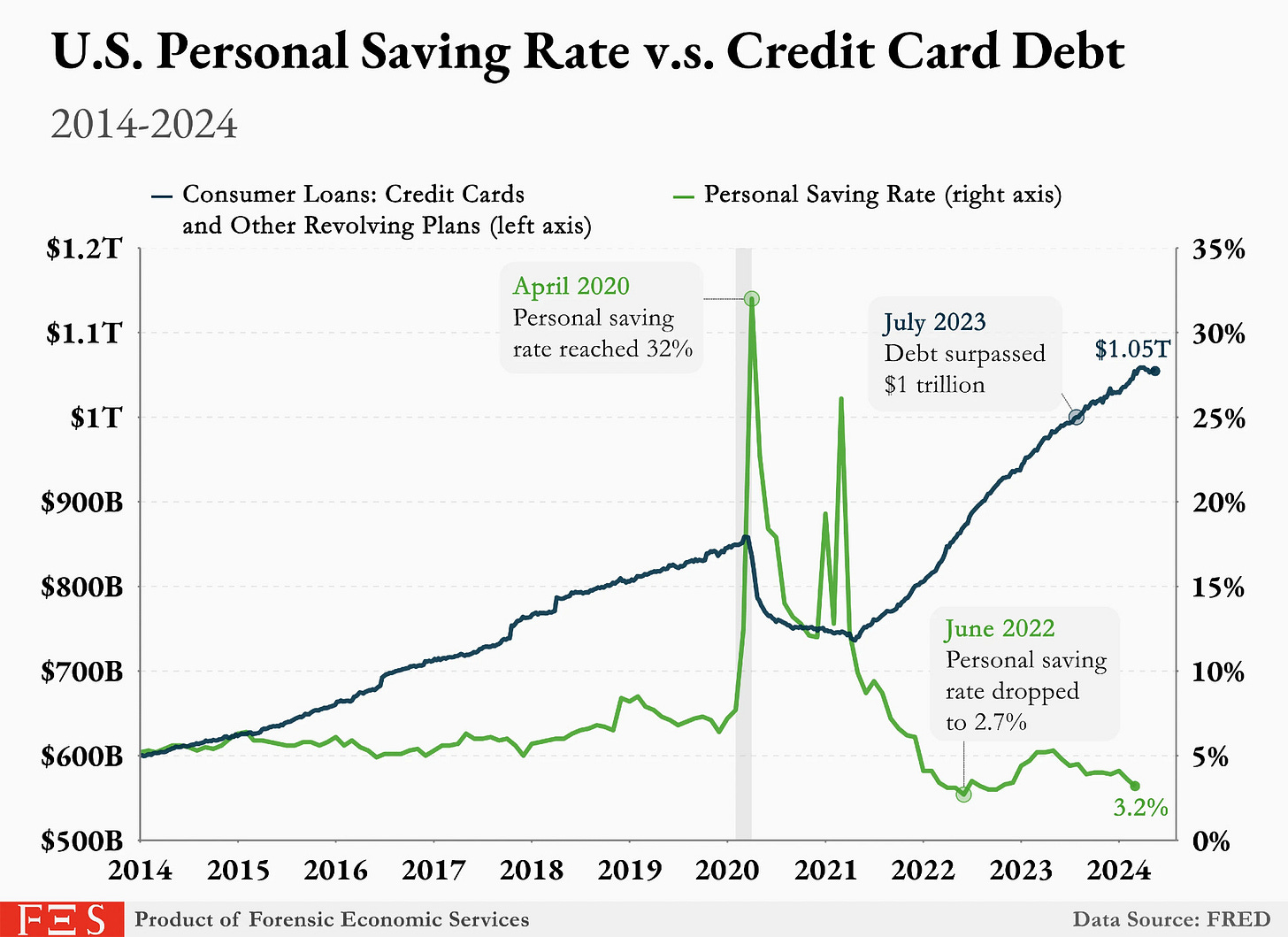

Investor capital also comes from stock in companies with viable revenue streams like cell phone manufactures, car companies, institutional landlords, etc. The problem is people are broke, and Trump's policies will make us broker. Credit Card debt is now north of a Trillion dollars, the personal savings rate is well below the norm. Deportations will worsen the labor shortage as the Silver Tsunami heats up, while tariffs will make everything more expensive, increasing debt. It might not be an obvious, single moment that kicks off the AI Winter, but as banks and VCs see their portfolios shrink with ordinary people’s wallets, they’ll get impatient and panicky. Eventually, someone will decide to dump their AI holdings and then the rest of rats will try to get off the sinking ship.

After the Crash

Immediately following the crash, we’ll see the typical consolidation of markets under the survivors. Tech companies and IP will be bought and sold into a smaller pool of players, and much reduced versions of the original products will limp along, likely only as paid services. LLMs will become a technological footnote, like the Home Robot fad of the 1980s, and most of the technology will languish for years until someone solves the explainability problem. Purpose-built and curated AI platforms that actually produce useful services will also be victims of the crash, but they’ll find new homes and continue to be used after the panic subsides, particularly in high technology fields like biotech and aerospace. Social media faces a far bleaker future. With high inflation, and investor confidence shaken to its core, few if any social media services will survive in their present form. An online dark-age will emerge, where many of the spaces and communities we know and even depend on will wither and die, preserved only the Internet Archive if we’re lucky.

The Digital Dark Age will last for most of the next recession, but to most people it will seem to last for probably a decade or more, as the economic model of the Reagan Era comes to a close (subject for another time). New online spaces will emerge, and old ones will attempt to continue under poorer quality than what we’ve known. Video hosting, gifsets, even images will become luxuries. Even UX design will have to be scaled back as companies will try to find anyway to ration data usage and keep costs down. The internet of the late 2020 sand 2030s will look more like it did in the 2000s or even the 1990s. Daily active users will decline, and I could even see some web services becoming nationalized if governments see them as essential to economic recovery.

Eventually, things will turn around for internet. The global economy will recover, a new normal for investment will come to pass, and new government regulations will take hold after an appropriate period of kicking and screaming from businesses and users. But Silicon Valley’s golden age will be behind us. New players will emerge offering novel solutions to higher cost of data, more than likely from places Silicon Valley outsources a good deal of their work like India, the Philippines, or Ukraine. Gradually internet will come to look like some version of what we have today, and even grow beyond it. But it will take at least a decade or more to get there, a decade defined by crappy products, little investor activity, and high tech unemployment. Silicon Valley will face a crossroads similar to what the Midwest faced in the 1980s and what the Northeast faced in the 1930s. They can adapt and use what resources they still have to become something new, or they stagnate and spend the next 50 years demanding that the government make everything like it was during their golden age. Given the personalities at play, I’d say its even odds that the Bay either turns into the next New York, or the next Gary, Indiana.