Trump's Recession

Get ready for the worst recession in your lifetime.

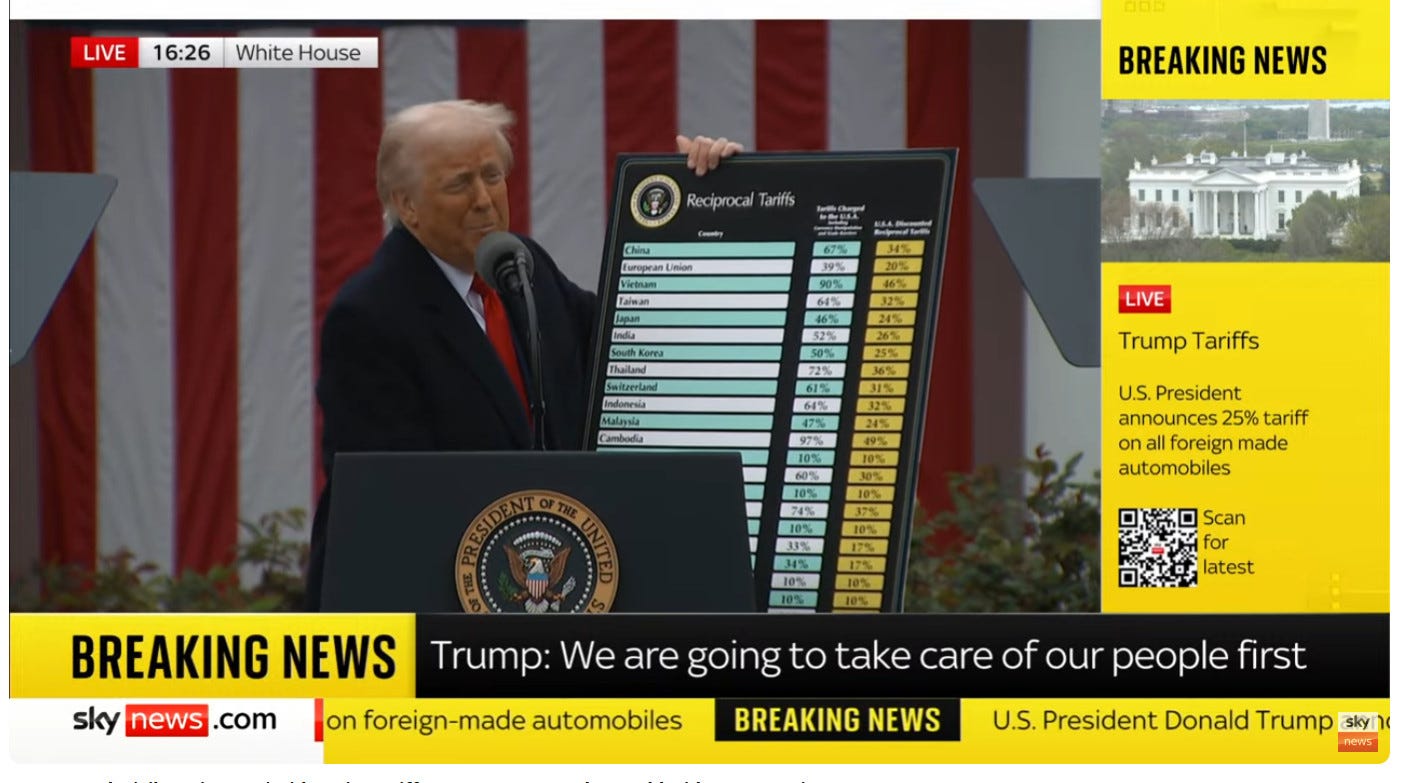

On Midnight April 3rd, 2025 the largest tariff increase in living memory will take effect courtesy of the trade policy of President Donald J. Trump. These tariffs will impose a baseline 10% tariff on every country, with select nations targeted for higher tariffs. These include a 20% tariff on goods from the European Union, 34% on China, 49% on Cambodia, etc. There will also be duties on specific goods like Aluminum duties that will add Beer and empty aluminum cans according to the US Commerce Department.

As these tariffs have gone into effect with no prior details made public, businesses have no time to come up with an appropriate response. Typical of Trump, a bad situation is being made worse by the addition of unnecessary chaos. I’ve already written about the major economic crises Donald Trump would face regardless of what policies he tried to bring about, but these self-destructive tariffs will make the impending recession far more grim.

First, its important to recognize that tariffs on foreign manufacturing is functionally a tariff on US manufacturing, despite what Trump’s supporters among industrial manufacturing might think. US manufacturing is an intermediate goods trade, meaning US manufacturers not only rely on foreign made inputs to build end-products, what US factories produce often isn’t even the end product. Instead, factories in the US build a component that bounces to other countries to become part of other products in a big interconnected global supply chain chasing the lowest possible costs and best value add. What this means is that the tariffs won’t be a flat rate, they’ll compound every time a product jumps the border, leading to insane price hikes even before you get to good old corporate greed.

As you can imagine, this will be particularly bad for any goods going between the US, Mexico and/or Canada as those are by far the most interdependent economies with the United States. Add to this the high tariffs on other high-tech manufactures like Taiwan, Japan, and the EU, it paints a devastating picture for the most advanced industries. The Tech Sector is especially vulnerable with its ongoing challenges, but we should be prepared for an immediate, cataclysmic recession in aerospace, automotive, semiconductor manufacturing, and energy.

Trump’s supporters are hoping that the pain created by these tariffs will be enough to decouple the US from a globalized supply chain it helped build, but to put it delicately: that is the stupidest thing anyone’s ever said. You can’t unravel 80 years of global supply chains and replace them with a home grown counterpart overnight. It gets worse when you consider how price spikes, in addition to the ongoing inflationary spiral, are more likely to create a contraction in available capital as consumer confidence craters. This leaves the market with fewer resources to jumpstart domestic manufacturing projects.

In addition to the recession in manufacturing that these tariffs create, they’ll intensify the retail apocalypse, particularly for apparel & shoe outlets. In addition to the tariffs on Chinese goods I previously mentioned, Trump’s tariffs includes a 44% tariff on goods from Sri Lanka, 29% on Pakistan, 37% on Bangladesh, 24% on Malaysia, 32% on Indonesia, 36% on Thailand, 46% on Vietnam, and 49% on Cambodia. Those account for the bulk of clothing and shoe exporters to the United States. The US labor pool is famously unwilling to work at wages

Finally, there’s agriculture. Around 1/6th of our food comes from imports, mostly things that the US just doesn’t have the climate to grow at scale, or have to be imported because the growing season in the Northern Hemisphere has ended. So expect price spikes for coffee, vanilla, chocolate, avocados, bananas, shrimp and prawns, canola oil, sugar, etc. This won’t do much to help American growers, because very little of what we import competes with domestic foodstuffs. So the only thing these tariffs will achieve is to increase the cost of living at a time when the personal savings rate is already on the floor.

A true, nationwide recession won’t immediately follow these tariffs, it will take a a few months at least for people to eat through their savings to the point that defaults on loans start to spike. But what was likely going to be a recession starting sometime in mid-to-late 2026 is now almost certainly going to start well inside of 2025. Industry-specific recessions will hit much sooner, leading to a spike in unemployment. With the country facing a labor shortage, this should be a temporary problem, except that the people being laid off first (engineers, technicians, etc.) are not trained to replace people in industries facing labor shortages (trucking, meat packing, construction, etc.) So even if this is supposed to be a manufactured recession to arrest inflation for the sake of billionaire tech bros who’s companies can’t survive without near-zero interest rates, it simply won’t work. Inflation will continue to rise while unemployment spikes, meaning Donald Trump just intentionally created a new Stagflation crisis.

The optimistic scenario going into next year was that we’d be facing increasing political instability and economic upheaval no matter what Trump did. We need to be prepared for that to start this summer instead, and to get more intense as we get into next year. There will be attempts to stop these tariffs, a few Senate Republicans have already joined with Democrats to try and stop at least some of Trump’s tariff policies. But even if such a bill passes the House, I doubt it would survive a Veto from Trump, simply because the Republican party is institutionally incapable of standing up to this President.

Globally, the situation gets even worse. As bad as things will get inside the US from these tariffs, export-dependent economies will be absolutely devastated. For all the talk of boycotting the purchase of American goods in Canada or the EU, nobody outside of the US has actually taken legal steps to halt or reduce exports. That would be economic suicide when dealing with the world’s largest importer. The US imports $3.4 trillion in goods and services a year, that’s bigger than the GDP of France. 13% of Chinese imports go to the US, 10% of Germany’s exports go to the US… and 77% of Canadian exports go to the American market. Countries like this are facing the prospect of devastating recessions, because even if they don’t directly sell to the US, some of their other customers do, and a reduction in exports means less money to buy exports from other exporters… and now you’re looking at a global recession the likes of which we haven’t seen since 1929. Side note the only countries on Earth not impacted by these tariffs are Russia and Belarus, and at this point you should not need anyone to explain why.

There’s really no historical analogue to compare to this moment. Its comparable to Herbert Hoover deliberately trying to create the Great Depression when he took office in 1929. Smarter people than I have written about some of the finer points of Trump’s tariff policies, and you should read their stuff, but the bottom line is that Trump has sunk his administration with this policy. A few Republicans are more afraid of their donors than Trump, and we’re already seeing defections emerging from those who take their marching orders from Wall Street. The public at large will grow more confrontational with the administration as the pain of this recession sets in, and the longer it goes on. Trump’s base are unlikely to abandon him, and you should be prepared for Trump to blame anyone he can think of in a desperate search of a scapegoat. This will all fuel a period of increased social unrest, violence, and vigilantism in what will surely be a Long Hot Summer for 2025.

While this large crisis is still taking shape, a much bigger one may be ahead if the Federal Reserve is gutted.